Contact Us to learn more about our services.

Optimism about Current Conditions Pushes Farmer Sentiment Index to All-time Hgh

James Mintert and Michael Langemeier, Center for Commercial Agriculture

James Mintert and gives his breakdown on the Purdue/CME Group Ag Economy Barometer February results at purdue.ag/barometervideo.

Download report (pdf)

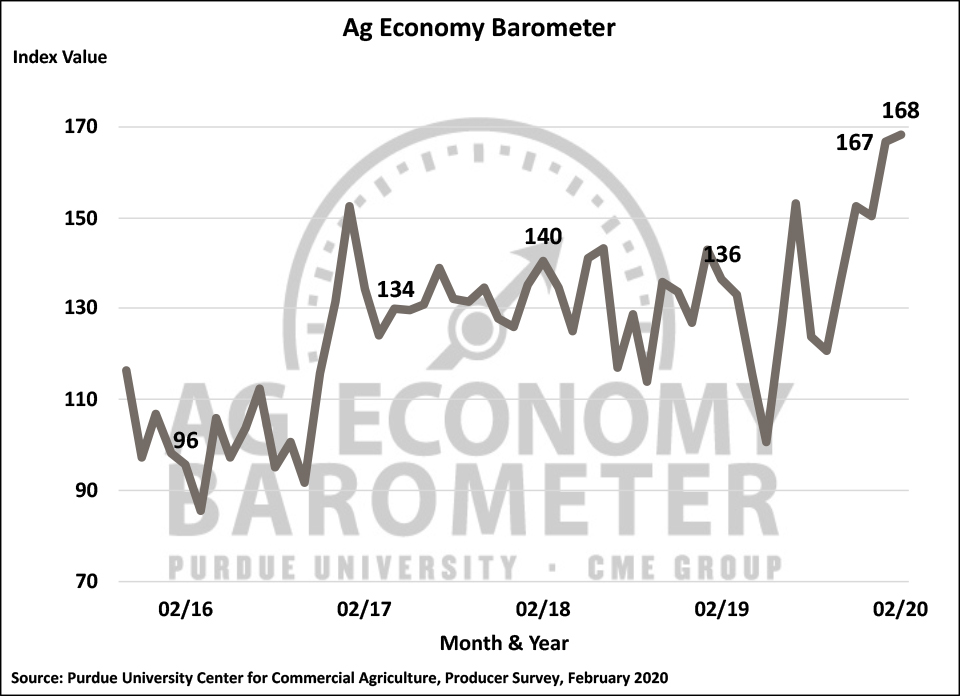

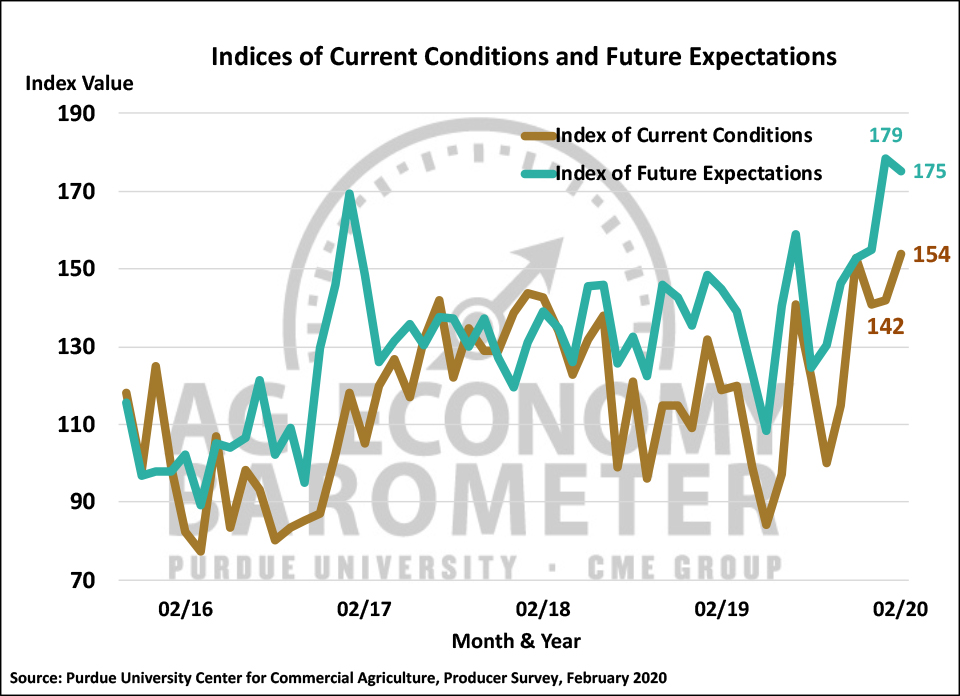

The Ag Economy Barometer rose slightly compared to a month earlier, with a reading of 168 in February, just one point higher than in January. The one-point rise in the sentiment index was enough to push the barometer to a new all-time high, eclipsing the previous record set in January of this year. The barometer’s strength was underpinned by an improvement in producer’s perceptions of current conditions, which offset a small decline in expectations for the future. The Current Conditions Index set a new record high in February with a reading of 154, up 12 points from January. Expectations for the future remained strong from a historical perspective, although the Index of Future Expectations reading of 175 represented a 4 point decline from its record high set in January. The Ag Economy Barometer is generated each month from 400 U.S. agricultural producers’ survey responses. This month’s survey was conducted from February 10-14, 2020.

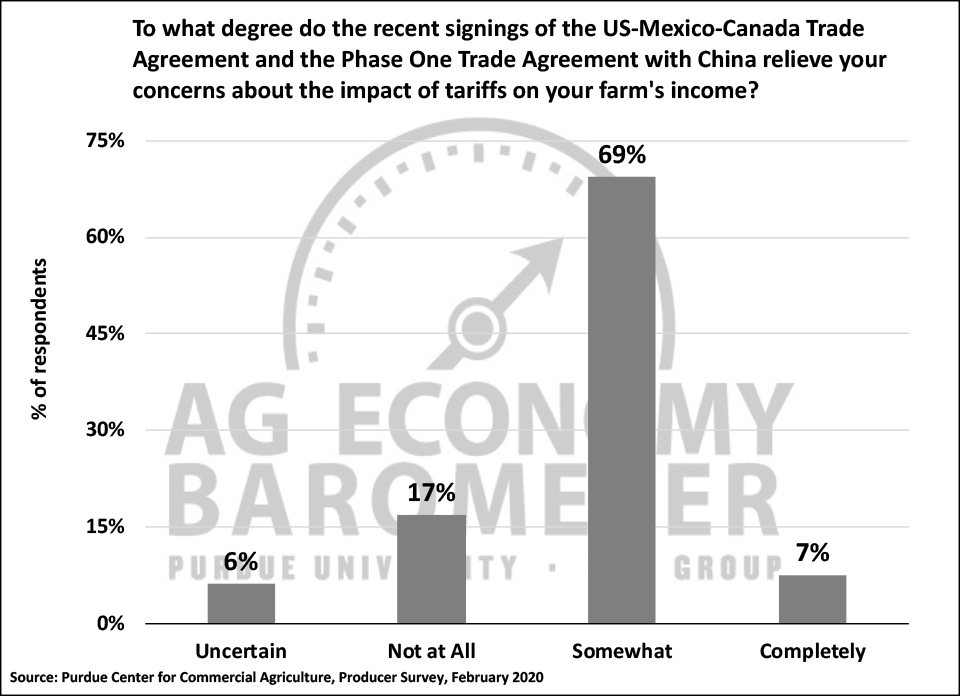

The rise in the Index of Current Conditions, to a new record in February, followed a sharp rise in future expectations in January. Concurrent with the improvement in perceptions about current conditions, producers retained nearly all of the optimism about the future that they recorded in January. Producers’ expectation of an improving ag export environment appears to be a major reason for the ongoing strength in both indices. Although some concerns existed about the possible impact of the COVID-19 virus on ag trade in mid-February when this month’s survey was conducted, producers remained relatively optimistic about the resumption of trade with China. The percentage of producers expecting the soybean trade dispute to be settled soon, which peaked at 69 percent in January, declined to 61 percent in February, yet this month’s decline needs to be kept in perspective. Notably, the February reading was the second most positive response recorded regarding the resumption of trade with China since we first posed this question in March 2019. Producers also remained optimistic that the trade dispute will be resolved in a way that’s favorable to U.S. agriculture with 80 percent expecting an outcome that is, ultimately, positive for U.S. agriculture. Although producers have consistently had a long-run positive outlook regarding the trade dispute, the average positive response to this question through the end of last year was in the low 70s. February was the second month in a row that 80 percent or more of respondents said yes when asked if the dispute will ultimately be resolved in a way that’s beneficial. Another indication that producers were more optimistic about the resumption of trade is the shift that’s taken place with respect to expectations for Market Facilitation Program (MFP) payments. Last fall approximately 6 out of 10 producers said they expected to receive an MFP payment for crops produced in 2020. In February, the percentage of producers expecting an MFP payment for the 2020 crop slipped to 45 percent. Note that this month’s survey was completed prior to President Trump’s tweet on February 21st indicating that if “…farmers need additional aid until such time as the trade deals with China, Mexico, Canada and others fully kick in, that aid will be provided by the federal government…”, which seems likely to impact producers’ expectations regarding future MFP payments. Finally, in this month’s survey we asked producers to what extent the recent signing of the USMCA and the China Phase One agreements relieved their concerns about the impact of tariffs on their farms’ income. Over three-fourths (76 percent) of respondents said the agreements either “somewhat” (69 percent) or “completely” (7 percent) relieved their concerns while 17 percent of respondents chose “not at all” as their response. Looking ahead, it remains to be seen how the ongoing spread of the COVID-19 virus and its impact on markets around the world will impact producers’ optimism about trade and future economic conditions in agriculture.

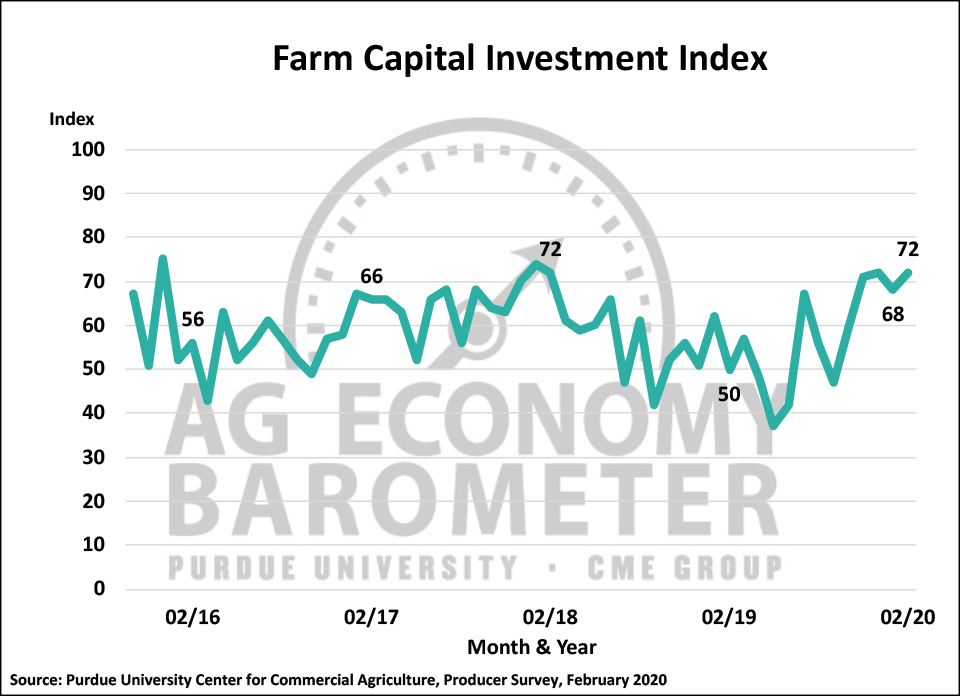

There was a modest improvement in the Farm Capital Investment Index this month. The index rose from a reading of 68 in January to 72 in February. Producers have had a relatively positive outlook with respect to making large investments in their farming operation going back to last fall as the index has ranged from 68 to 72 since November. Investment index readings over the last four months have been noticeably stronger than in late summer and early fall, when the index ranged from 47 to 59.

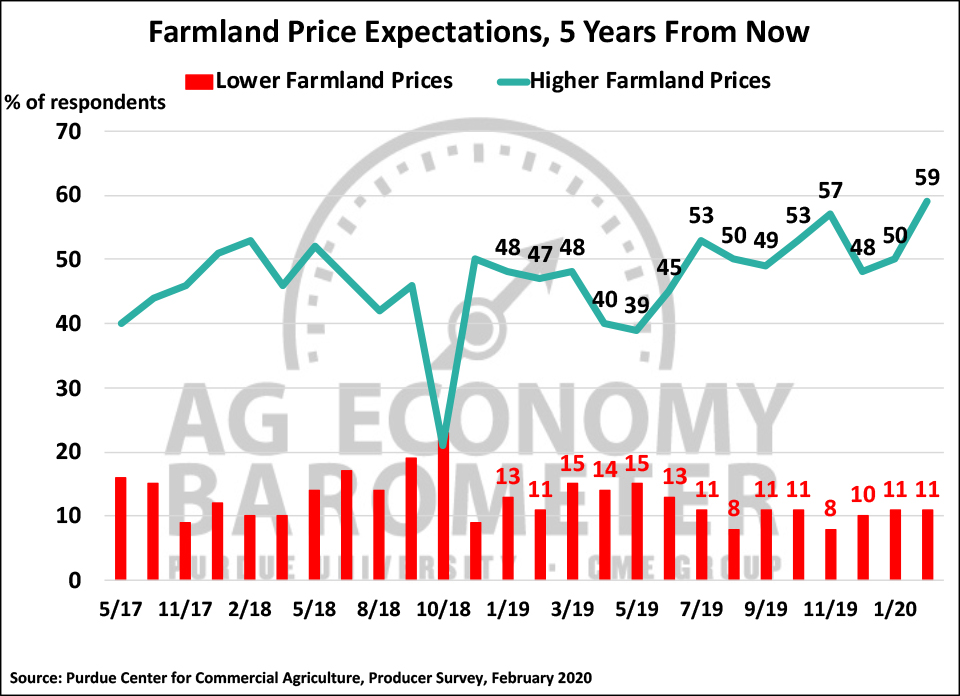

Consistent with the improvement in the investment index, producers were also more optimistic about farmland values this month. When asked to look ahead 5 years, 59 percent of producers said they expect farmland values to rise, up from 50 percent a month earlier. This was the most positive response to this question since data collection began in 2015. The increase in optimism was attributable entirely to a shift among producers away from expecting no change in values to expecting an increase in farmland values.

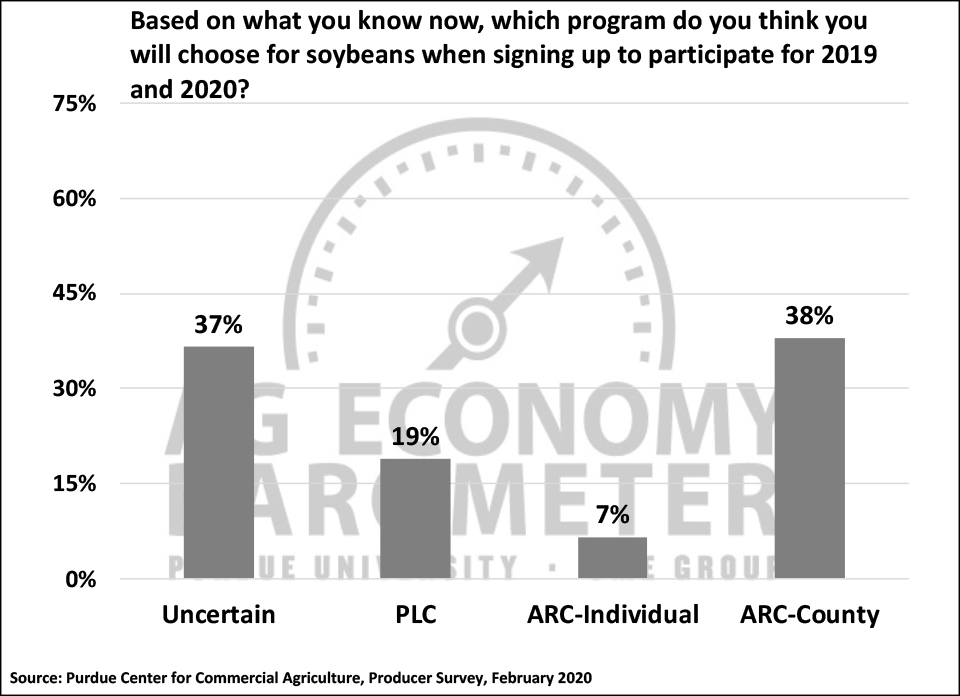

There is still a lot of uncertainty regarding which program producers will choose when they make their program choice under the 2018 Farm Bill, which needs to be made by March 16, 2020. This month’s survey focused on producers who grew soybeans in 2019. Among soybean farmers, nearly four out of 10 (37 percent) said they were still uncertain regarding which program they would choose. Nearly 40 percent of respondents said they planned to choose the ARC-County program, which was the most popular program under the 2014 Farm Bill. There appeared to more interest in the Price Loss Coverage (PLC) program than under the 2014 Farm Bill as 19 percent of soybean producers in our survey planned to choose it. There was also more interest in the ARC-Individual Coverage program than under the previous Farm Bill as 7 percent of respondents indicated that would be their program choice.

Wrapping Up

Ag producer sentiment remained strong in February as the Ag Economy Barometer not only retained the large increase that took place in January, but actually rose slightly above it. Producers were more optimistic about current conditions on their farms and in U.S. agriculture and retained most of the improvement in expectations for the future that they exhibited in January. Optimism about the agricultural trade outlook appeared to be the primary driver behind the improvement in sentiment. Producers in February were more inclined to say that now is a good time to make large investments in their farming operation and also thought it more likely that farmland values would rise over the next 5 years than a month earlier. As the deadline for the 2018 Farm Bill sign-up approaches, there remains a good deal of uncertainty about program choice with nearly 40 percent of producers still undecided. Finally, although the COVID-19 virus was a topic of some concern when the February survey was conducted, it remains to be seen what impact the disease’s increasing footprint around the world will have on farmer sentiment.